Traditionally, wrap-up premiums have been calculated as a rate per $100 of on-site payroll exposure; however, over the last several months, we have seen a trend towards premium calculations as a rate based on construction value. If underwritten correctly, this rating basis could make auditing and final premium calculations simpler for all parties involved.

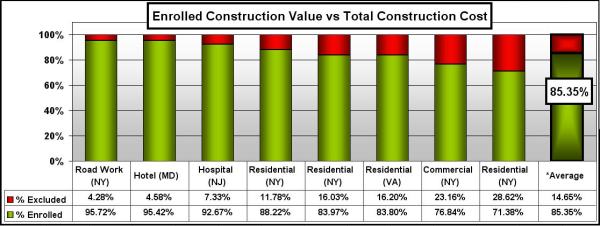

The only problem lies in defining the term’s construction or contract value and ensuring that the original program projections take this definition into consideration. Insurers often define construction value as the total hard cost of a project or the total contract award to the GC/CM. Alternately, brokers assume that construction value only includes the value of all enrolled contractors, excluding the values for contractors specifically excluded from the wrap-up. In both situations, understanding the dynamics of the enrollment and exclusion process along with the associated trends and historical data is vital to create an accurate projection of a wrap-up’s future premium exposure. Thus, we took a look at 8 separate wrap-up jobs and compared the total enrolled construction value to the total construction value. Overall, 85.35% of the total construction value was enrolled in the wrap-up, leaving 14.65% of the construction cost not enrolled. As seen in the graph below, the rate of exclusion changes by location, type of construction, and the wrap-up sponsor’s objectives. Being aware all of these factors is tantamount to a well marketed and accurately projected wrap-up insurance program.